About My Car Credit

Part of the UK's largest motor finance broker Evolution Funding

Our goal has always been to make car finance online as simple and accessible as possible, no matter what your credit score – allowing you to buy the car you want, at the budget you can afford.

How we stand out

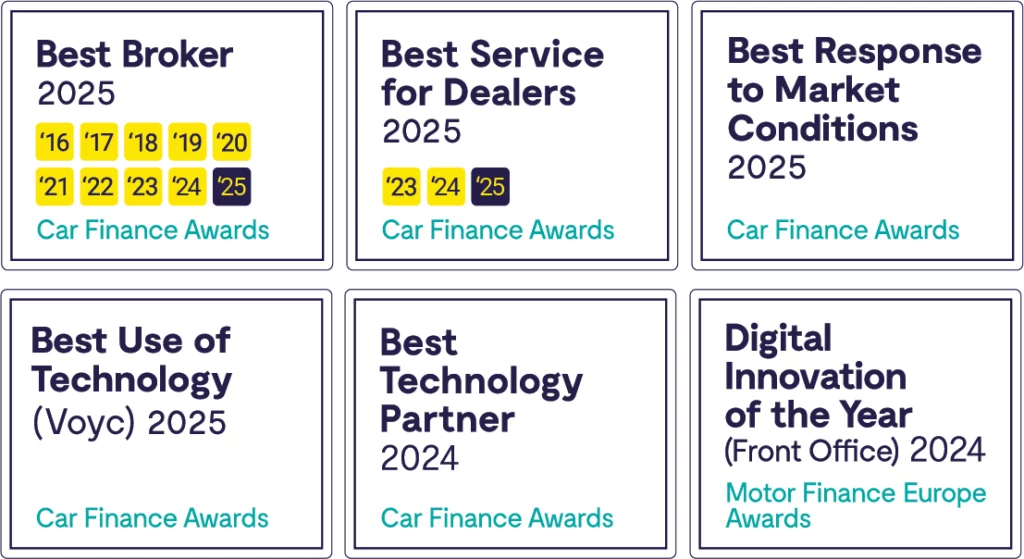

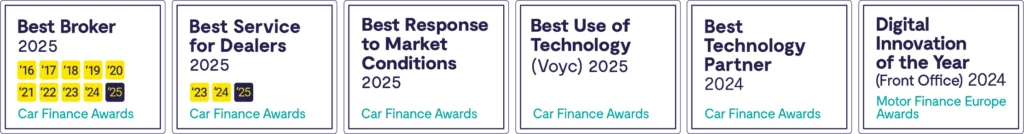

We’re part of the UK’s largest motor finance broker, Evolution Funding. Our award-winning technology combined with our broad lender panel improves your chances of being accepted for car finance.

We have the largest panel of car finance lenders out of any UK broker. What’s more, we’ve developed special technology which matches you with the best product and lender for your circumstances. This improves your chances of an acceptance, at a rate you’re happy with. This is completely unique to Evolution Funding, and is something we’re very proud of!

In 2015, My Car Credit was launched, aimed at those customers who want to easily shop around for car finance online.

We focused on creating a quick and simple application process. Our Car Credit Specialists then handle your application right through to payout, providing advice and support where it’s needed.

Even better, we’ve built up relationships with over 5,500 reputable car dealers throughout the UK. This means we have a pool of My Car Dealers who can help you with sourcing the perfect nearly-new or used car!

How My Car Credit makes car finance asay

Play Video

Play Video

While buying a new car is an exciting process, sorting out the finance is never quite so fun. With so many different car finance providers, it’s hard to know whether you’re getting the right deal for you – not to mention all the red tape and paperwork.

Thankfully, My Car Credit has a simple goal – to make car finance straightforward for all of our customers. We help you buy the car you want at the budget you can afford.

If you want to shop around for car finance online, apply when you’re ready and get advice and support when it’s needed, then you’re in the right place. Here’s how it works:

Use our free car credit calculator to work out your monthly payments depending on how much you want to borrow and the length of your deal.

Apply online and we’ll match you with the right deal and lender depending on your circumstances.

Search our network of nearly-new cars from trusted dealers to find your perfect used vehicle.

Need any help? Our friendly team of Car Credit Specialists are on hand to help whenever you need them.

Why Choose My Car Credit

My Car Credit ticks every box for UK customers who want the right car finance minus the hassle – and without putting their credit score at risk.

To start with, we have an expert team with a wealth of experience finding suitable deals for drivers just like you. They offer invaluable knowledge of the car finance process and trustworthy providers, so we can find you the best deals without any hidden surprises.

My Car Credit also boasts access to a wide panel of lenders through Evolution Funding – the largest motor finance broker in the UK. Wave goodbye to legwork with hours comparing deals. My Car Credit will do the heavy lifting for you. Just give us the info and let us get to work on your behalf.

That’s paired with a risk-averse approach which aims to protect your credit score when matching you with a deal. Rather than performing hard searches up front, we start with a soft check to get an idea of your circumstances and affordability. Lenders may perform a hard credit check further down the line, but we keep searches soft when comparing deals.

The icing on the cake? We have a network of trusted car dealers, so you can find a nearly-new car as part of the car finance process. No need to search for weeks and tackle the minefield of buying a used car. Like every other part of your journey, we make it simple!

My Car Credit reviews

As the UK’s largest car finance broker, we have a reputation to uphold! We work hard to ensure our customers have the best possible experience and we’re really proud of the feedback we receive. Take a read of some of our favourites and also check us out on Reviews.co.uk.

Ready to get started?

It couldn’t be easier to start your application with My Car Credit. Submit a few simple details using our online application form and let us get to work on your behalf.

If you’d prefer, you can start with our used car search to find the perfect vehicle from a trusted dealer. Or browse our extensive range of help articles to familiarise yourself with the car finance process.

Require more help?

Can’t find the information you’re looking for? Need some support or guidance? Get in contact – our friendly and experienced Car credit Specialists are here to help!

Require more help?