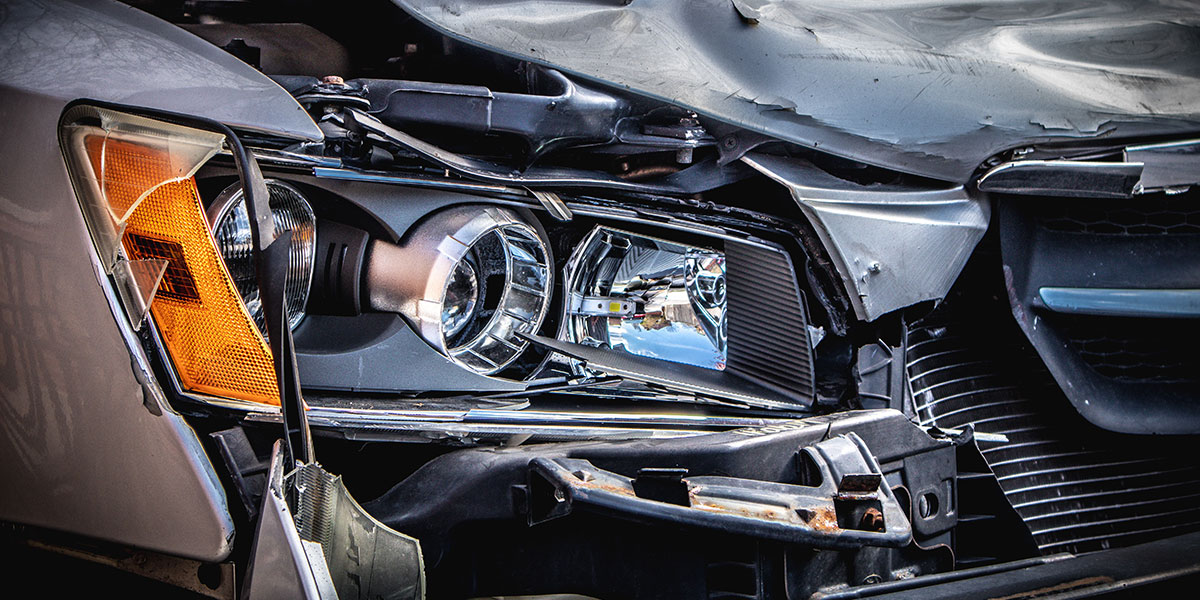

If your car on finance is written off as the result of an accident, there are a number of things that you can do depending on the degree of damage.

It’s of utmost importance to contact your insurance and finance provider, as well as the DVLA, if you are in an accident and think that your car may consequently be written off. Depending on the severity of damage sustained, there are two main steps that you can take, as this post will explore.

What is a write-off?

When a vehicle is written off by an insurance company, it usually means one of two things. Either the damage is so extensive that the vehicle can’t be repaired, or the cost of the repairs required is higher than the vehicle’s total value. As such, a vehicle can be written off even when the damage doesn’t appear that bad – it just has to fit into one of these two categories.

Your vehicle can be written off whether you acquired it via car finance, or if you’re the outright owner.

The different kinds of write-offs

There are four main kinds of write-offs – if your vehicle fits into any of these descriptions, it’s likely to be written off.

Category A

This occurs when a vehicle is completely unsuitable for repair, and no body parts can be used for scrap material. It’s the most severe kind of write-off.

Category B

This is when the vehicle has significant damage to its body, and is therefore not suitable for repair. Usable parts can still be salvaged and used for resale or repairs.

Category S

Previously known as category C, this occurs when vehicles sustain structural damage such that it is unsafe to drive without repair. Depending on the degree of damage, it may be more cost-effective to purchase a new vehicle.

Category N

Previously category D, this is when there is no structural damage and subsequent impact on the vehicle’s function, but some cosmetic, electrical, or non-structural repairs may still be required. Vehicles are placed into this category when an owner decides not to repair it.

What to do if your car on finance is written off

Remember, if your car is involved in an accident that might result in its being written off, you need to contact your finance and insurance providers as well as the DVLA. This should be done as soon as possible, so that you can take the necessary next steps.

Once your insurance provider has placed your vehicle into one of the four above categories, you’ll be offered a settlement price. This is the amount that your insurer is willing to pay out for the vehicle, and will usually equate to the amount that the vehicle was worth at the time of write-off.

You can dispute the write-off decided upon by your insurer by entering into negotiation with them, or by contacting the Financial Ombudsman Service.

Your options for a written-off financed car

Once your insurance provider has established the write-off category into which your financed car falls, you can decide on your next steps. These will usually be either buying the car back and repairing it, or buying new.

Remember, if your vehicle fits into either category A or B, you will not be able to buy the car back to repair it, as it has been deemed unroadworthy.

Buying a new car

You can use the insurance settlement to purchase a new vehicle. You will still need to repay your monthly instalments of car finance on the written off car. Depending on the insurance payout, you may be able to use this money to clear the outstanding balance on your finance agreement, but this will depend on your finance provider. It’s always best to contact them to gauge whether they allow this or not.

Buying back the vehicle and repairing it

This only applies to vehicles in category S and N. Remember that you’ll need to keep up with monthly repayments whilst the vehicle is in for repair, and check whether your repaired vehicle needs a new insurance policy, MOT, or to be re-registered with the DVLA.

Car finance that isn’t a write-off

At My Car Credit, we provide crisis-proof car finance and unflappable customer service. Should the worst happen, we have a team on hand to help you with any queries. Or if you’re looking to finance a car to replace a write-off, you can use our car finance calculator to get you a no-obligation quote within minutes.

Rates from 9.9% APR. Representative APR 10.9%

Evolution Funding Ltd T/A My Car Credit

Require more help?

Got a question you can’t find the answer to, or need some advice and guidance around taking out car finance? Our Car Credit Specialists are friendly, experienced, and here to help so get in touch today!