Breaking down can be a very negative experience in more ways than one. To avoid being stranded on the road with the burden of a broken car, you need to opt for a breakdown cover policy.

Breakdown cover

Breakdown cover will vary depending on your insurance policy and can provide anything from basic roadside assistance to vehicle recovery and onward travel. If you drive on a regular basis, it’s vital that you know your options and how they can work for you.

Types of breakdown cover

Personal

Personal breakdown cover will protect you as an individual in any vehicle that meets the agreed specification of your policy. This kind of cover enables you to claim as the driver or passenger of a broken-down car and (depending on the policy) may also cover people that live at the same address.

Vehicle

Vehicle breakdown cover will allow you to claim for the specific vehicle outlined in your policy, regardless of who’s driving it.

Levels of breakdown cover

Once you’ve decided on the type of breakdown cover you want, you have to choose the level of cover.

Roadside assistance

This usually comes as standard when you take out breakdown cover and means that a breakdown team will come to your location and aim to get you back on the road again. If they can’t fix your car on the roadside, they will tow it to the nearest garage.

Vehicle recovery

In the event that your car can’t be fixed, vehicle recovery enables you and your vehicle to be taken by the breakdown team to a destination of your choosing. This is especially advantageous if you are a long way from home and have no other way to get back.

Home breakdown

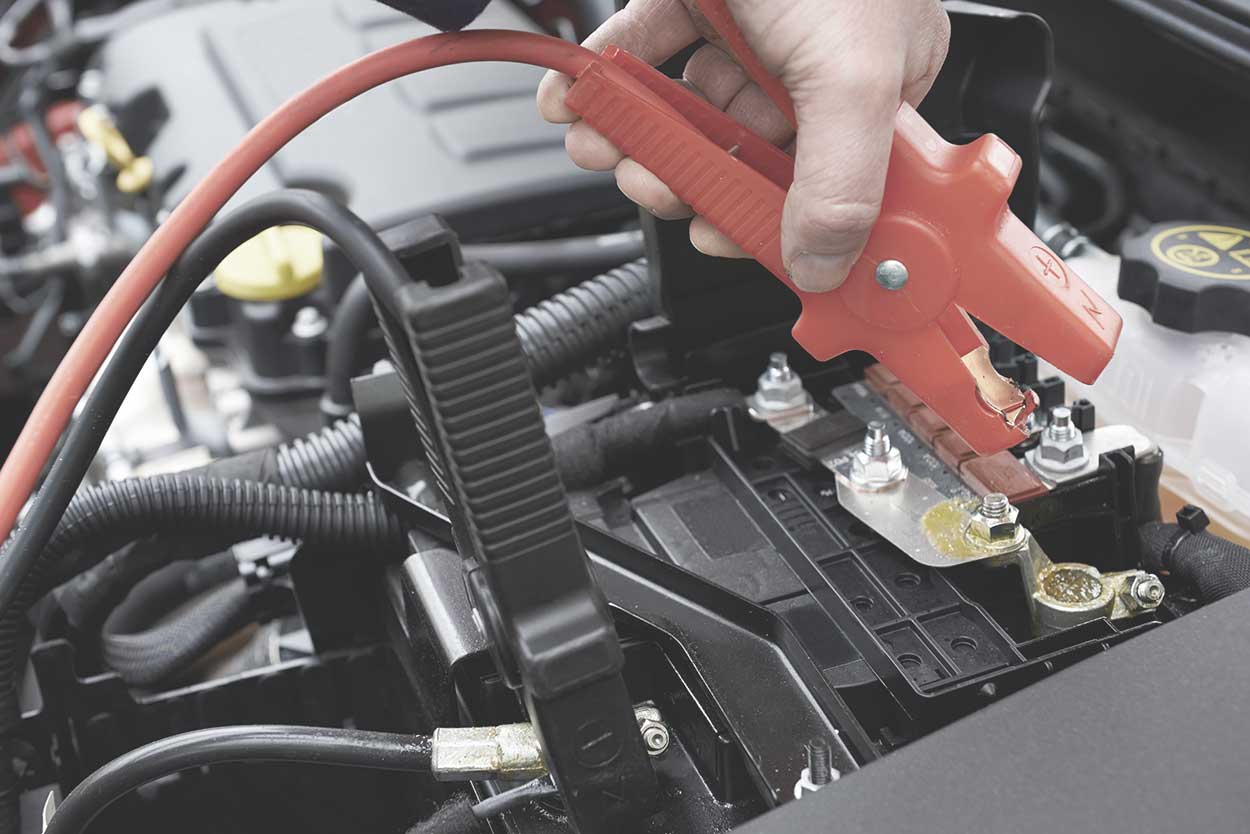

If your car won’t start at home, this enables you to get a breakdown team sent to your home to fix it. This is more common than you might think, with flat batteries causing a lot of cases.

Onward travel

This kind of cover enables you to complete the journey that you were on when you broke down if your car can’t be fixed. Onward travel cover has a number of options attached to it, including a courtesy car, overnight hotel accommodation or public transport.

Optional extras

Once you’ve selected the main options to your breakdown cover, there are also optional extras you can add on.

- Multi-car can cover multiple cars and/or drivers that live at the same address

- European breakdown cover will cover you when you’re abroad

- Key replacement in the event that they are lost, damaged or broken

- Battery replacement with no service fee

- Tyre replacement

- Wrong fuel cover, in the event that you have mistakenly re-filled with the wrong fuel

If you drive regularly, it’s important to get breakdown cover. Being stranded on the roadside is inconvenient and potentially dangerous. We hope our complete guide will help you to understand your options and choose the best option for you.

Require more help?

Got a question you can’t find the answer to, or need some advice and guidance around taking out car finance? Our Car Credit Specialists are friendly, experienced, and here to help so get in touch today!