The police have been given the power to conduct roadside eye tests. Penalties include fines of £1000 and three points on the motorist’s driving licence. Those who fail could also potentially face driving disqualification.

According to the ‘Don’t swerve a sight test’ campaign by the Association of Optometrists, statistics on the vision of UK drivers are sobering.

62% of people are delaying a sight test. Meanwhile, almost a fifth of all people who need glasses to drive have not had their eyes checked for at least three years, such that 36% are wearing an out-of-date prescription. Most shockingly, the data also showed that one in ten drivers said they would continue driving even if their vision was unsafe to do so.

Compromised vision can increase the risk of an accident, and two-fifths of UK adults feel that the current laws on sight requirements should be more rigorous. As such, the police have been given new powers to carry out roadside tests.

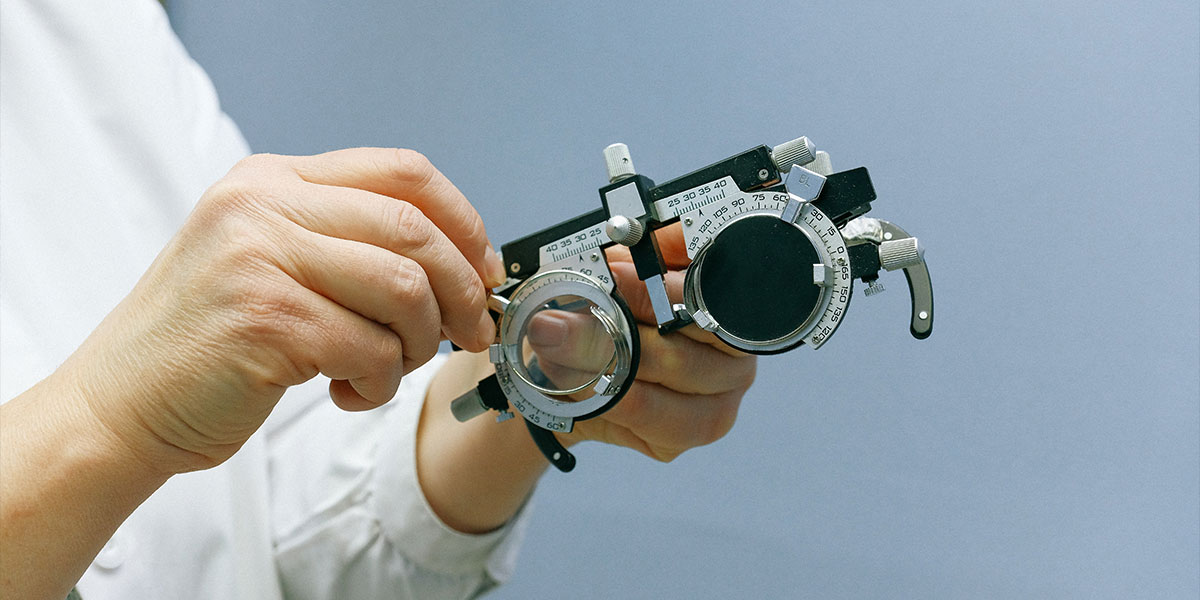

What will these new roadside eye tests consist of?

The UK police has now been given the power to carry out roadside eye tests. If a driver is pulled over, they will need to be able to read a number plate 20 metres away in order to pass.

This is a standard part of the driving test for all qualifying drivers. The AOP has called it ‘deeply concerning’ that drivers are only expected to demonstrate standard driving vision at this stage, with no repeat test over the years. The new roadside eye tests have been introduced to counter this issue.

The lack of regular vision testing mandated by the UK compares poorly to other European countries. According to the AOP, in countries like Italy, Spain and Hungary, drivers have to undergo a vision test every ten years. Countries such as Italy, Spain, Portugal and Greece all require drivers of 65 or younger to have regular vision tests.

If drivers are unable to complete the test, this could result in a fine of £1,000 and three points on their driving licence. In more serious cases, drivers can even face disqualification.

Different kinds of drivers need different standards of vision. Similarly, if drivers have particular medical conditions that impact the sight of both eyes, they must inform the DVLA.

Since the introduction of this new police power, the elderly and vision impaired are being advised to have their eyesight checked as soon as possible.

According to the Department for Transport, some 42% of incidents involving drivers aged 70 years and above were due to sight issues.

If you are overdue on an eye test and wear glasses or contact lenses, ensure that you book in with your optometrist as soon as possible to avoid the risk of fines or harsh penalties for failing roadside eye tests.

Drive safely with My Car Credit

Upgrade to a safer vehicle by checking your car finance eligibility with My Car Credit. Alternatively, contact us today by emailing enquiries@mycarcredit.co.uk.

Rates from 9.9% APR. Representative APR 10.9%

Evolution Funding Ltd T/A My Car Credit

Require more help?

Got a question you can’t find the answer to, or need some advice and guidance around taking out car finance? Our Car Credit Specialists are friendly, experienced, and here to help so get in touch today!