There’s no denying that COVID-19 disrupted almost every aspect of modern life, from how we work to how we shop. Lockdown had millions of Britons working from home, while many others were furloughed. The restriction on work and social lives meant that there was a significant reduction of vehicles on the road.

Since June, the government has pared back lockdown and is gradually reducing restrictions. Many of us are heading back to work and we can begin to visit family and friends again, while maintaining social distancing, of course.

With the surge of motorists back on the road, it’s incredibly important to be more diligent while driving. If you are getting behind the wheel for the first time in several weeks, take a look at our top tips on how to drive safely.

1. Prepare your vehicle

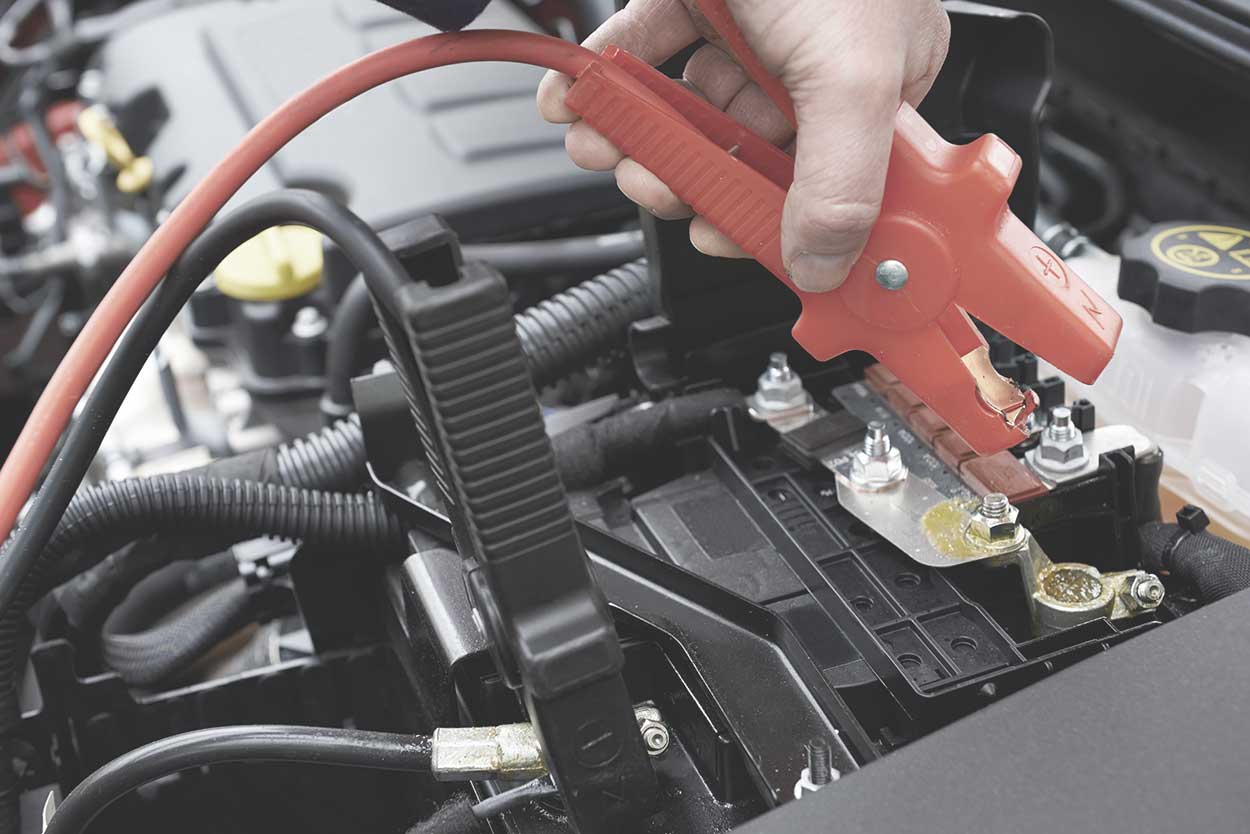

Your car may have been sitting for weeks on end. Before you head out on the roads, ensure that it is roadworthy. After a long period of inactivity, it’s possible your car’s battery will be flat. Inspect the tyres, ensuring the correct air pressure and that there are no cracks in the sidewalls.

Check the engine oil, lights and top up the fluids before setting off. When you need to top your car up with fuel, ensure that you are wearing gloves when handling the pump and paying.

2. Clean and disinfect

Whether you’re heading back to work, popping out to the shops or dropping off goods to vulnerable family members, your car needs to be kept clean and disinfected. Since the coronavirus can live on surfaces for up to 72 hours, it’s wise to ensure your vehicle is not a carrier of these harmful germs.

Wear appropriate personal protective equipment (PPE) to minimise the chance of coming into contact with the coronavirus. Wear gloves, a mask and an apron that are either washable or disposable.

Start by cleaning your vehicle by removing dirt, dust and debris from the interior. Next, use a disinfectant to spray over the dashboard, steering wheel, gearbox, handles, buttons, seat belts and visors. Wipe down with a clean microfibre cloth that is immediately put into the washing machine. Don’t forget to clean the interior and exterior door handles as well as the boot handle.

3. Plan ahead

Before setting off, plan a route to get to your destination. Be aware that certain road conditions may have changed in the last few weeks and there could be temporary closures and delays.

4. Slow down

There may be fewer cars than normal on the roads, which make it tempting to speed to shorten your journey. However, speeding is never the answer. Stick to the speed limits or below, especially as you get used to being behind the wheel if you haven’t driven in a while.

5. Carry hand sanitiser

Washing our hands is just as important as it was before to slow the spread of the coronavirus. However, not everyone has access to soap and water when they are out and about. Instead, many resort to the next best option – hand sanitiser.

Keep a bottle of hand sanitiser in your vehicle that is at least 60 percent alcohol to use before leaving the vehicle and upon returning. Keep the bottle out of direct sunlight as the heat could reduce its effectiveness and turn it into a potential fire hazard.

A new vehicle for your new needs

If you find yourself using your car more often or less frequently after lockdown, or if it’s just looking worse for wear, it may be time to upgrade your vehicle.

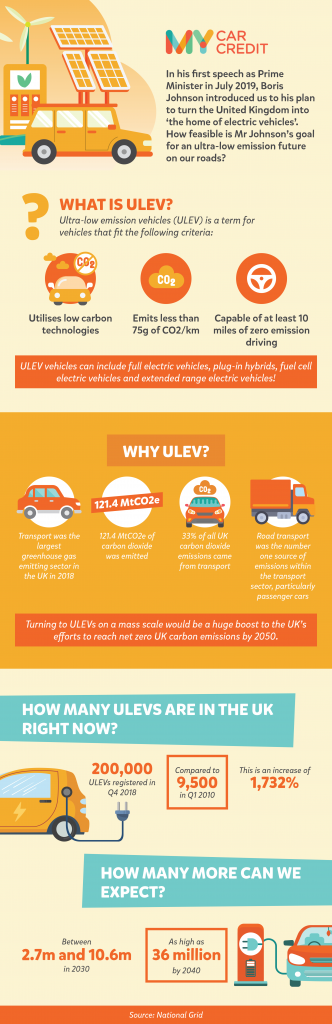

At My Car Credit, we can help you secure the right car finance that suits your needs and budget. We are operating business as usual and are ready to help you today. Calculate car finance and then apply to get started.

Rates from 9.9% APR. Representative APR 10.9%

Evolution Funding Ltd T/A My Car Credit

Require more help?

Got a question you can’t find the answer to, or need some advice and guidance around taking out car finance? Our Car Credit Specialists are friendly, experienced, and here to help so get in touch today!