A new car on the driveway feels great. A huge upfront payment? Not so much. That’s where personal contract purchase (PCP) finance comes in.

PCP offers low monthly payments, lots of flexibility and the chance to drive a newer car more often. At the end of the term, keep it, swap it or hand it back. No pressure, just options. It’s no wonder PCP is one of the most popular auto financing options in the UK.

Looking for a clear guide on PCP finance explained? Continue reading to get a simple, easy-to-understand breakdown of how PCP finance works and what it means for you, from deposits and balloon payments to hidden costs and the best ways to save money.

What is PCP car finance?

Personal contract purchase works differently from other auto finance options like personal contract hire (PCH) and hire purchase (HP). Instead of paying off the full cost of a car, PCP covers only depreciation (this is the difference between the car’s price today and its predicted value at the end of the contract).

- Lower monthly payments than options like HP

- More choice at the end of the contract. Keep the car, swap it or hand it back

- Access to newer, more expensive cars for less

No big upfront payments

Like other finance options, PCP helps spread the upfront cost of getting behind the wheel. Instead of saving for months or dipping into savings, drivers pay an initial deposit and start driving straight away. Some deals even offer zero-deposit PCP, making it easier to upgrade without a large lump sum. Since monthly payments only cover depreciation, rather than the full cost of the car, upfront costs stay low while still providing access to newer models.

PCP works best for those who change cars frequently or want an affordable way to drive something newer. If you want personal contract purchase explained in a way that highlights affordability, this structure makes it clear why PCP is such a popular option.

PCP finance explained: how does finance work on a car?

Instead of paying off the full value of a vehicle, drivers cover depreciation only. This means lower monthly payments compared to options like hire purchase. At the end of the term, instead of owning the car outright, there’s a decision to make:

- Keep it

- Trade it in for something new

- Hand it back and walk away

The process starts with an initial deposit, followed by fixed monthly payments over an agreed period, usually between two and four years. When the contract ends, a balloon payment (also called the Guaranteed Future Value) determines whether the car stays or goes.

For those who like swapping into something fresh every few years, personal contract purchase keeps things simple – providing lots of options without long-term commitment.

A PCP deal breaks down into three key parts:

Deposit – the upfront payment

Unlike a traditional down payment that reduces the total loan amount, a PCP deposit helps cover the car’s depreciation.

A higher deposit lowers the monthly payments and makes finance more affordable over time. Some dealers offer zero-deposit PCP deals, but these usually mean higher monthly costs. The deposit also reassures lenders, showing commitment to the agreement and improving approval chances.

How much is a PCP deposit?

Usually 10% of the total value of the car. So, if you’re buying a new Ford Fiesta worth £20,000 you’ll pay a deposit of £2,000 upfront. If you’re looking at a BMW X5 worth £70,000 your deposit will be £7,000.

Can you get a PCP deal with no deposit?

Yes, some lenders offer zero-deposit PCP deals. But they’re usually reserved for applicants with excellent credit scores. Keep in mind that monthly payments increase without a deposit, because the entire finance amount is spread across the contract term. Skipping the deposit keeps upfront costs low but it also means higher long-term payments and potentially more interest paid overall.

Just want PCP car finance explained simply? A deposit reduces the amount borrowed, which lowers monthly costs and the total interest paid.

What happens to the deposit?

The deposit isn’t refunded at the end of the agreement. That said, if the car is worth more than the Guaranteed Minimum Future Value (GMFV) at the end of the contract, this difference can go towards the deposit on a new PCP deal.

Is it worth paying a bigger deposit?

While a larger deposit lowers monthly payments, it doesn’t always make financial sense. Paying too much upfront ties up cash that could be used elsewhere, and since PCP isn’t structured for outright ownership, a big deposit won’t necessarily bring major benefits. If keeping the car at the end is a priority, some drivers prefer to spread costs evenly and put money aside for the final balloon payment instead.

Can a part-exchange be used as a PCP deposit?

Yes, a trade-in vehicle can be used towards the deposit on a new PCP deal. If the car being traded in is worth more than the settlement figure, the difference can go towards the next agreement, lowering the amount borrowed. This can be a great way to upgrade without needing a lump sum upfront.

The amount you borrow

Unlike HP, where the loan covers the full cost of the car, Personal Contract Purchase only finances a portion of the vehicle’s value. The amount borrowed is based on how much the car is expected to depreciate over the course of the agreement, not the car’s total price.

How is the PCP loan amount calculated?

PCP finance is structured around three key figures:

- The car’s price today

- The Guaranteed Minimum Future Value (GMFV)

- The deposit paid upfront

The difference between the purchase price and the GMFV (minus any deposit) is what gets financed.

For example, a £30,000 car with a GMFV of £15,000 after three years means the car is expected to lose £15,000 in value over the contract term. If a £3,000 deposit is paid upfront, the amount borrowed would be:

£30,000 – £15,000 – £3,000 = £12,000 financed

This £12,000 loan is then spread across monthly payments. Explaining PCP finance simply – borrowers only pay for the car’s depreciation, rather than its full value.

How depreciation affects monthly payments

Depreciation plays a major role in PCP affordability. Cars that hold their value well (think premium brands like BMW, Audi or Lexus) often have lower monthly payments because the gap between the initial price and the GMFV is smaller. On the flip side, payments can be higher for vehicles that lose value quickly, as the finance company takes on greater risk.

This means two cars priced at £30,000 but with different depreciation rates could result in very different PCP payments:

Car A (low depreciation)

GMFV of £18,000 after three years.

Borrowed amount: £30,000 – £18,000 = £12,000

Car B (high depreciation)

GMFV of £12,000 after three years.

Borrowed amount: £30,000 – £12,000 = £18,000

Despite the same purchase price, Car B costs £6,000 more to finance, meaning higher monthly payments.

How to reduce the amount borrowed

Drivers looking to cut monthly costs have a few options:

- Choose a car with strong resale value – A higher GMFV means borrowing less.

- Increase the deposit – A larger upfront payment reduces the amount financed.

- Opt for a shorter term – Lowering the contract length can improve the GMFV.

- Negotiate a lower interest rate – A lower APR means smaller finance charges.

The balloon payment

A balloon payment is the final lump sum due at the end of a PCP agreement. Unlike HP, where monthly payments gradually cover the full cost of the car, PCP leaves a significant balance unpaid until the final stage of the contract. This unpaid balance is called the Guaranteed Minimum Future Value (GMFV) and is an estimate of the car’s worth at the end of the agreement.

This model keeps monthly payments low but leaves drivers with a decision at the end of the term. Three options are available:

- Return the car – Walk away with no further costs

- Buy the car – Make the balloon payment

- Part-exchange – Trade it in for a new deal

What if the car is worth more than the balloon payment? Good news. If the car holds more value than expected, the extra amount can go towards a new finance deal.

We’ll cover all three in more detail below!

How does PCP work at the end of the term?

PCP finance explained – it keeps things flexible right up to the final stretch. When the contract ends, there’s no pressure to stick with one path. Drivers choose what works best for them. Whether it’s handing the car back, keeping it or using it to fund a newer model, the options stay open.

Here’s how it plays out:

Return the car

Nothing more to pay with this option. Just hand the car back to the lender and walk away.

Best for: Drivers who like to upgrade their car regularly or want flexibility at the end of the contract.

No extra cost if: The car stays within mileage limits and remains in good condition.

Possible charges: Exceeding mileage limits or returning the car with excessive wear and tear could result in fees.

Buy the car

Want to keep the car? You’ll need to cover the balloon payment in full. This figure is set at the start of the agreement and reflects what the car should be worth at the end of the term. No surprises. Just a final bill standing between you and outright ownership.

Best for: Drivers who want long-term ownership or find the car’s value higher than the agreed GMFV.

No more finance payments: Once the balloon payment is settled, full ownership transfers to the driver.

Consider the cost: The final payment can be hefty. Some drivers choose to refinance the balloon payment with another finance deal to spread the cost.

Part-exchange

If the car ends up worth more than the GMFV, the difference can go towards the deposit for a new PCP deal. A handy way to roll into a newer model without a big upfront cost.

Best for: Drivers who like upgrading without saving for a large deposit.

Equity boost: If the car’s market value exceeds the GMFV, the extra amount reduces the deposit on a new PCP deal.

No guaranteed profit: If the car holds less value than the GMFV, no equity remains for a new deal.

Choosing the right PCP exit strategy

Flexibility sits at the heart of PCP. No long-term commitment, no pressure to stick with the same car. Just options that fit different needs. Whether it’s upgrading, keeping or trading in, drivers stay in control.

- Best choice for frequent upgraders? Hand the car back and start a new PCP deal.

- Best choice for keeping the car? Cover the balloon payment or refinance.

- Best choice for rolling into a new deal? Trade the car in and apply the equity towards a fresh PCP agreement.

Benefits of PCP

There’s lots to love about PCP finance. Here’s a closer look at the benefits:

Lower monthly payments

PCP agreements focus on the car’s depreciation rather than its full cost. Instead of covering the entire value, payments go towards the difference between its original price and its expected worth at the end of the contract. With smaller monthly costs than options like hire purchase (HP), this keeps budgets in check while keeping options open.

More car for your budget

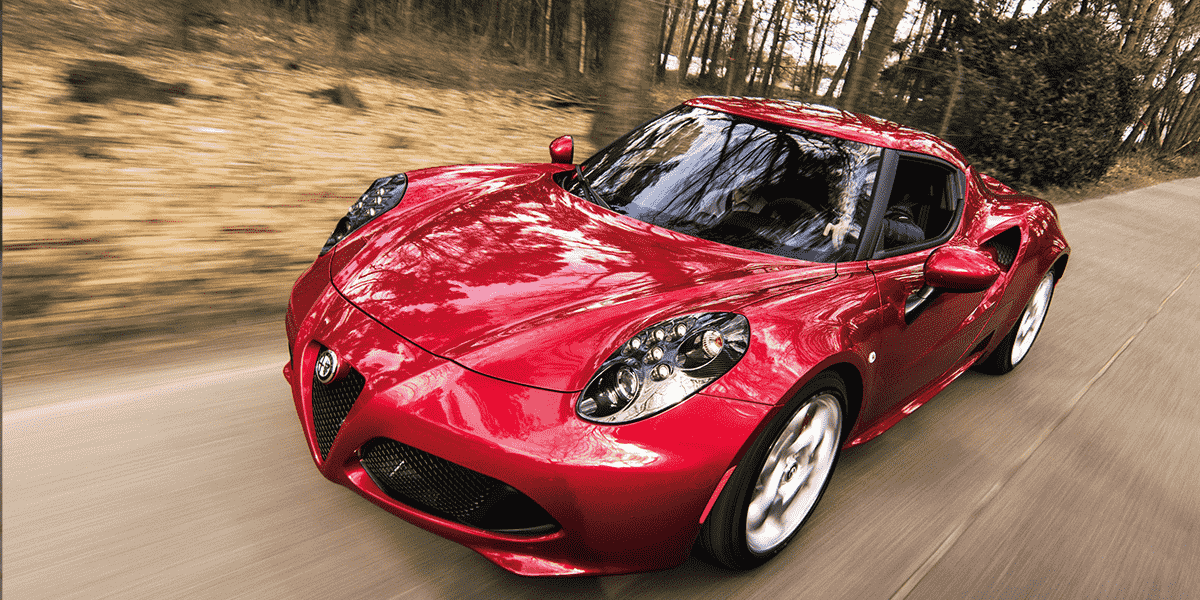

PCP stretches budgets further. A standard finance deal might cover a reliable runaround, but PCP offers access to something newer, sleeker or better equipped. A mid-range trim instead of the base model, a hybrid instead of petrol, leather seats instead of cloth. For drivers after the latest comfort or tech without breaking the bank, PCP makes it possible.

Flexible at the end

PCP offers more than one way out. Pay the balloon payment and keep the car. Trade it in and roll any equity into a fresh deal. Or hand it back and walk away. No pressure to commit upfront. No long-term ties. Just options that suit different circumstances.

Smaller upfront costs

PCP explained – it makes car finance more accessible, with lower deposits, or sometimes none at all. No need to drain savings or hold off for months to build a deposit. Just a manageable way to get behind the wheel.

Equity potential

If the car’s value sits higher than the GMFV, the difference rolls into the next deal as a deposit. A model with strong resale value means a better starting point for the next agreement. While never guaranteed, this can work in favour of drivers looking to upgrade without saving separately for a deposit.

Drawbacks of PCP

PCP has some great benefits but it’s important to understand the full picture before committing. Here’s a look at some of the potential drawbacks:

Mileage restrictions

Every PCP agreement includes a mileage limit. Drive beyond it, and fees apply per extra mile. The cost might seem small per mile, but over the years, it adds up. Best to estimate mileage honestly at the start rather than face a surprise bill later.

Condition requirements

Normal wear and tear are expected, but anything beyond that might mean extra charges. Scratches, dents, scuffed alloys or a coffee-stained interior could lead to fees. Keeping the car in good nick avoids unexpected costs at the end of the contract.

Final payment required to own the car

PCP doesn’t include ownership at the end unless the balloon payment is settled. Drivers wanting to keep the car need to cover this amount, often requiring extra savings or a refinancing deal.

Total cost may be higher

Interest applies not just to the borrowed amount but also to the balloon payment. This means, over time, the total amount paid could exceed what a similar car would have cost with an outright purchase or HP. Weighing up affordability against flexibility is key.

How to cut your monthly PCP car finance payments

PCP already stands out for its lower monthly payments. But with a bit of strategy, those payments can shrink even further. Here’s how to make PCP even more affordable.

Increase the deposit

A bigger deposit means borrowing less from the lender. Less borrowing leads to smaller monthly payments, keeping costs manageable over time. Most PCP agreements require at least 10% upfront, but putting down more trims down repayments even further. Worth considering if savings allow, but balancing affordability is key. No point in sinking all available funds into a deposit if it leaves nothing for running costs.

Choose a car with slow depreciation

Cars lose value over time, but some hold onto their worth better than others. Luxury brands, electric vehicles with strong demand and popular models tend to retain value, making them better suited to PCP deals. A higher resale value means a lower balloon payment at the end, keeping costs lower throughout the contract. Checking resale trends before picking a car can save a fair bit over the term of the deal.

Extend the contract length

PCP agreements usually run for two to four years, but stretching to five years spreads the cost further. Monthly payments drop, making it easier to budget. A longer contract does mean paying more interest overall, but for those prioritising lower monthly outgoings, it’s a sensible trade-off. Don’t forget, keeping within the expected mileage limit is important! Going over could mean extra charges, even with a longer term.

Look for low APR deals

Interest rates play a big role in the overall cost of PCP finance. A lower APR reduces the total amount paid over time, so it’s worth shopping around to find the best deals. Some dealerships and manufacturers offer promotional APR rates at certain times of the year, so timing a deal well can also mean decent savings.

What you need for PCP finance

Before getting started with a PCP deal, lenders check a few key details to make sure applicants meet the requirements. Nothing too complicated but having everything in order speeds up the process. Here’s what’s needed:

- Personal details – Full name, date of birth and residential address history (usually covering at least three years). Lenders like stability, so a consistent address history helps.

- Employment details and income – Current employer, job role and income details. Self-employed? Some lenders ask for tax returns or bank statements as proof of earnings.

- Bank details – Account number and sort code for setting up the monthly payments. Some lenders also check banking history to assess financial stability.

- Identification documents – A valid UK driving licence or passport confirms identity. You might also be asked for proof of address, like a recent utility bill or council tax statement.

- Credit history check – Lenders run a credit check to see past borrowing behaviour. A strong credit score helps unlock better rates, but options exist for those with less-than-perfect records.

With these details ready, the PCP process moves along smoothly. A bit of prep upfront makes all the difference.

PCP vs. other auto finance options

Still not sure if PCP is your ideal route? Now we’ve got PCP finance explained, let’s compare it to other options to get a better understanding of the pros and cons:

Hire purchase (HP)

HP agreements let you spread the cost of the car over a set term, but instead of options at the end of the agreement you own the car outright. It’s like paying off a mortgage and owning your home when the final instalment is made.

Personal contract hire (PCH)

PCH agreements involve leasing a vehicle throughout the duration of a contract. Unlike PCP and HP loans, PCH doesn’t involve borrowing money for car ownership. Instead, you initiate the leasing agreement with a non-refundable deposit and then make monthly ‘hire’ payments that give you use of the car. At the end of the contract, you’ll return the vehicle without the option to purchase it and become the outright owner. It’s important to note that PCH agreements often come with restrictions, including mileage limits and caps on acceptable wear and tear.

Personal loan

With a personal loan, you borrow a lump sum to purchase the car and own it from day one. Interest rates are usually significantly higher for personal loans.

Why choose My Car Credit for PCP finance?

At My Car Credit, we’re your trusted co-pilot when it comes to securing the best PCP finance deals. Why choose us for PCP finance?

- Expertise: Our team has the knowledge and experience to guide you through the entire PCP process, from start to finish. If you need PCP finance explained, we have your back.

- Variety: We work with a wide range of lenders to offer you the best PCP deals. Worried about having car finance declined? As well as high street banks, we partner with smaller lenders who can help you get finance, even if your credit score is less-than-perfect.

- Choice: As well as partnering with a wide range of lenders, we offer a huge amount of choice when it comes to cars. No need to limit yourself to particular makes and models. We pride ourselves on helping every client secure the keys to their dream car, whatever that might be. It’s like having access to a huge showroom of cars, all in one place.

- Flexibility: We tailor our PCP agreements to suit your specific needs, offering you a good amount of flexibility when it comes to things like deposit size, contract length and vehicle options.

- Support: Need your Personal Contract Purchase explained? We’re here to answer your questions, provide guidance and make your PCP journey as smooth as possible.

Ready to get behind the wheel? Give us a call on 01246 458 810 to find out more about PCP finance options or email us at enquiries@mycarcredit.co.uk for a speedy response.

Frequently asked questions about PCP

What does PCP stand for?

Personal Contract Purchase.

Is PCP car finance a good idea?

PCP works well for low monthly payments and flexible choices at the end.

What if I want to end my PCP car finance contract early?

Early termination is possible but may include settlement fees.

How does PCP work at the end of the term?

The car can be returned, traded in or bought outright.

What are the risks of PCP car finance?

PCP keeps things flexible, but it’s not without its pitfalls. Go over the mileage or hand the car back with a few too many scuffs, and expect extra charges. That balloon payment at the end? Not exactly pocket change. And if the car’s value takes a nosedive, there’s no leftover equity to put towards your next set of wheels.